Stock options can be very difficult concepts for people to grasp. It does not help that many websites and vlogs that attempt to explain options fail to explain them in the simplest of terms possible. I do not know if I’ll do any better, but my goal is to try and do just that. Of course, in explaining them that way, they will be oversimplified and no major strategies will be discussed. For ease of understanding, terminology will also be kept to the bare minimum. With the most basic of understanding, this guide should help you to be able to trade all the different basic types of stock options.

There Are Two Stock Options Types: Calls And Puts

There are only two types of stock options, calls, and puts. Each type of option is actually a contract that you enter into when you trade them. A standard options contract gives you the right to buy or sell 100 shares of a stock at a certain pre-agreed upon price, called the strike price, by a specified date in the future. The specified date in the future is called the expiration date. The expiration date is the date that the option contract expires on and must be executed by. Usually, the contract is for an option to buy or sell 100 shares of a stock a week or more into the future.

Ok. I’m already going to repeat and rephrase what I just explained for emphasis. It is vital to understand this point before reading on. Standard stock options are contracts to buy or sell 100 shares of a stock at a certain price (known as the contract’s strike price) and at a certain date in the future called the contract’s expiration date. One stock option contract is a contract for 100 shares.

If you enter into a stock options contract, one of 3 things can ultimately happen with that contract. The contract either expires with nothing happening, the contract gets executed, or you can terminate the contract early through the act of buying it out or selling it to someone else. For simplicity’s sake, this post will focus on the first two possibilities.

Why Do People Trade Options Contracts?

People trade options contracts for many reasons. But those reasons and how to’s are not going to be covered in depth by this article. I’m sticking to the basics. People generally get involved with stock options contracts for the following reasons:

- To establish a position in a stock without requiring a lot of money up front

- To try and generate steady and incremental income

- To hedge their positions and reduce risk in a stock they already own

Call Options

Once again, there will be no deep dives here into explaining what call stock options are. That will be left for another post. Instead, the aim is to give you a very basic understanding of call options in a way that’s easy to follow.

So what’s a call option? One call option is a contract to buy or sell 100 shares of stock at a certain price in the future. It’s called a call because when the contract reaches its expiration date, you may have shares that you own of a stock called away from you and sold to someone else. Alternatively, someone else may have their shares of stock called away from them and sold to you.

Let’s take a look an extremely simplified look at how this works in practice.

Buying Call Options

A Quick Overview

- Buying calls is generally a bullish proposition

- You will typically buy them when you believe the stock will go up

- Buying calls can allow you to take a position in a stock without a lot of capital needed

- Buying calls can make you a lot of money with little invested

- Buying calls can cause you to lose all the money you invested in them if the stock never reaches the option contract’s strike price

Someone buying call options in a stock is making a bullish bet on that stock. They believe the price of the stock is going to go above a certain price (the contract’s strike price) by a certain time (the contract’s expiration date). Let’s take a look at how this type of trade may be executed.

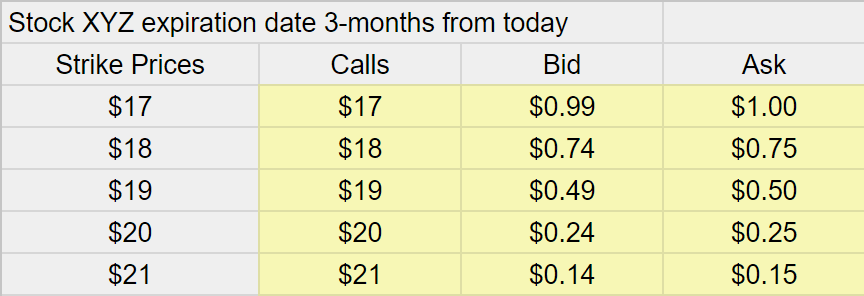

Stock XYZ is currently trading at $17/share. You do not own stock XYZ but think the price of the stock is going to go up significantly. You decide you’d like to gain the right to buy stock XYZ in the future if the stock goes up to a price of at least $20/share. Buying that call option will allow you to take a position in the stock without spending nearly as much money as it would cost you to buy the stock outright. So you go and take a look at the XYZ stock call options contracts that are available with an expiration date exactly 3-months from today. You see that the $20 call option (also known as $20 call strike price) costs 25 cents and you decide you want to go and buy one contract. So what does this mean if you buy the contract? It means you are entering into a contractual agreement with someone for the right to buy 100 shares of stock from them if the price of the stock reaches at least $20/share 3-months from now. It is essential to understand that the price you are shown for the call option contract is the price you must pay for each share that makes up the contract. So even though the call option shows that it costs 25 cents, that won’t be what you end up paying to actually buy the contract. Since a contract is good for 100 shares, the price you will actually pay to enter the contract will actually be $25. That’s because 25 cents per share times the 100 shares that make up the contract is equal to $25.

Ok, now let’s imagine it’s now 3-months into the future and stock XYZ is trading at $24/share. We are at the call contract’s expiration date. Can you guess what’s going to happen and how this impacts you?

You ultimately paid $25 for the right to buy 100 shares of stock XYZ as long as the stock price was at or above $20 at the call contract’s expiration date. So at the end of the day, when the market closes and since the stock is at $24, the contract will execute. You will buy 100 shares of the stock from the person who sold you the call contract. You’ll be buying the shares at a price of $20/share as that is the price you agreed to buy them at when you bought the contract. And you’ll have an instant $4/share profit by doing so, minus the $25 you paid for the call contract. Pretty sweet. But what would happen if stock XYZ was actually trading at $15 instead of $24 at that point in time? You end up with nothing. You lose the $25 you paid to buy the call contract and have nothing to show for it. That leads us to the other half of trading calls. Selling them.

Selling Call Options (Also Called Covered Calls)

A Quick Overview

- Selling calls is generally a bearish proposition

- You generally sell calls when you believe the stock won’t go up or will trade sideways for an extended period of time

- Selling calls results in the generation of income

Buying call options in a stock is a bullish bet, but in order to buy calls, there has to be a seller. The party selling calls is generally making a small bearish bet on that stock. Call sellers typically believe the stock will not reach a certain price by a certain time in the future. Let’s take a look at how such a trade may turn out in practice.

Let us revisit the example above, except this time, imagine you are the one that owns 100 shares of stock XYZ at $17/share and you are the one that sells a call contract instead of buying it. You sell a contract at the $20 strike price for 25 cents. You are making this move because you don’t think the price of the stock will reach $20 by the time the contract expires.

How do you think this trade could potentially work out for you if the stock price ends up going above $20/share? How do you think it would work if the stock price stays below $20/share. If you fully understand how buying call option contracts work, you should be able to figure this out. Take a minute to think about it before reading on to see if you got it right.

Alright, so stock XYZ is trading at $17 a share right now, and you just sold 1 call contract to someone that expires 3-months from now at a strike price of $20. Since you sold something, you are making money. Your account will receive an instant $25 credit for the contract you sold. Rember from the earlier example, a contract to sell the stock if the stock price reaches $20 had a cost attached to it of 25 cents for the contract. And since that’s a per-share cost, and a contract is 100 shares, you end up with a $25 deposit into your broker account. And that money is yours to keep no matter what happens to the stock.

Now, imagine it’s 3-months into the future at the call contract’s expiration date and stock XYZ is now trading at $24/share. If I have explained things well enough to you, it should be clear what is going to happen. At the end of the day, your shares are going to be sold to someone for $20/share because you agreed to do so when you sold a call contract. That means you lost out on an additional $4/share gain because you have to sell your shares to someone at $20/share instead of $24. That is not necessarily a bad thing depending on your reasons for selling the call contract in the first place, but it is what happens. You still made money on your stock. You bought it at $17/share and sold it at $20/share for a $3/share gain. Plus you made the additional $25 for the call contract you sold.

Now let us take a look as to what would have happened if the stock price was below $20/share at the call contract’s expiration date. If the stock was trading at $19/share at the contract’s expiration date, nothing happens to your shares. You keep your shares and you still keep the additional $25 you made by selling the call contract. So selling the call contract actually made you more money than had you not sold one at all.

It is important to know that you cannot actually sell calls without owning shares of the stock itself. In this sense, the contract you enter by selling a call to someone can be fulfilled or “covered” by the fact that you already have the shares to sell to someone in the event that the contract executes.

Are Selling Covered Call Options Right For You?

People tend to have mixed opinions on the practice of selling covered calls. I’m in favor of selling them for a few different reasons. Number 1 is that most contracts actually expire out of the money. So most of the time, if done right, you won’t be forced to sell your shares at the contract’s expiration date if that is something you are worried about. Second of all, selling covered calls acts as a small hedge. What happens if the price of the stock you own goes down over time? If you sold a call, you won’t lose as much money. The covered call acts as a small hedge against the loss. Third, what happens if the stock you own trades sideways for months? You don’t make any money on that stock, but if you sold covered calls, you do make money.

Now people that don’t like selling covered calls don’t like doing so because of FOMO (fear of missing out). They are afraid that if they sold a covered call at $20 and the stock ends up hitting $40 they are going to miss out on doubling their money. And that very well could happen. So they think it isn’t worth it for that reason. Of course, there are fairly easy ways to work around this. For example, you could buy calls in XYZ at a higher strike price than the ones you sold. You could sell calls at the $20 strike price for 25 cents and buy calls at the $22 strike price for 5 cents. That way you can still sell covered calls and still get most of the gain that you would if the stock did in fact pop to $40. But again, that’s a more advanced topic left for another post.

Are Buying Call Options Right For You?

From our earlier example, I pointed out to you that if you buy a call option and the stock never reaches the price that you agreed to purchase the stock at, you lose all the money you invested in the call option. Most bought call options with a strike price well above today’s stock price never reach the agreed-upon strike price, and so someone buying a call like this is taking on a big risk. On the other hand, buying calls also allow you to theoretically take a position in a stock with very little money down and have the potential to yield lottery winning type returns. The lottery winning type returns is the allure for many, but buying them like a lottery ticket is also the reason why most people lose money on them.

Put Options

Put options share a lot in common with call options, yet they are also quite different.

Just like calls, you can buy and sell put option contracts. And of course, one put option contract is equal to 100 shares of stock.

But unlike call options, where a call gives you the right to buy or sell a stock, a put option is more about forcing either you or someone else to buy shares of strock at an undesirable price if the put options contract executes. When we buy a stock put option contract, we are obtaining the right to assign or put stock into someone else’s account at an undesirable price for them. Conversely, if we sell a put option contract, we are giving the right to someone else to force put shares into our account at what may be an undesirable price for us. This might sound a little bit confusing. But I think with a couple of short examples, it should hopefully not be confusing at all.

Buying Put Options

A Quick Overview

- Buying puts is generally a bearish proposition

- Typically you will buy puts to make money if the stock goes down in a stock you don’t own. They may also be bought to protect from losses in a stock you do own.

- Buying puts can allow you to take a position in a stock without a lot of capital needed

- Buying puts can make you a lot of money with little invested

- Buying puts can cause you to lose all the money you invested in them if the stock never falls below the strike price you purchased the put contracts for

Someone buying put options in a stock is generally said to be making a bearish bet on the stock. They believe the price of the stock is going to go down significantly over time. Here’s an example of how buying put options may play out.

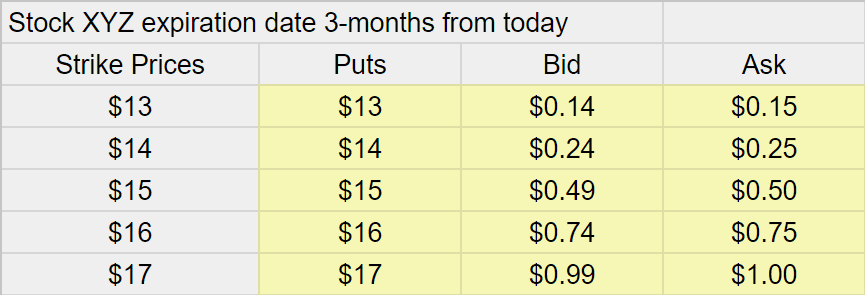

Let’s go back and revisit our stock from above, stock XYZ. Let’s imagine once again that stock XYZ is trading at $17/share. And once again you don’t own stock XYZ, but this time you don’t understand why anyone would want to own the stock at a price of $17/share. You think that price is too high and the price is heading for a collapse. So what you decide to do is buy 1 put option contract that expires in 3-months. You think the stock is going to fall well below $15/share so you go and buy one put contract at a $15 strike price that has a contract price of 50 cents. And again, one option contract is equal to 100 shares, and the cost of a contract is on a per-share basis. So although the price of the contract shows as 50 cents as depicted in the table below, buying the contract will cost you $50 (50 cents per share times 100 shares in a contract).

Ok, let’s now fast forward to 3-months into the future where stock XYZ is now trading at $10/share. We are at the put contract’s expiration date. You were right, the stock price collapsed. Can you guess what’s going to happen to your put contract?

You bought a put contract, which gives you the right to force put shares onto someone else, ie force them to buy shares from you if the stock is below a certain price, in this case, the $15/share strike price. Since the stock is below $15/share on the put contract’s expiration date, the contract will execute. And it will work out behind the scenes like this: At the end of the day, you’ll get to buy shares on the open market at a price of $10/share and they will then immediately be sold to the person you bought a put from at $15/share. So you make a profit of $5/share ($500) on the transaction minus the $50 you paid to buy put contract. That’s a pretty nice gain.

Now that you learned the basics of how buying a put option contract works, can you guess how selling put option contract works?

Selling Put Options (Cash Secured Puts)

A Quick Overview

- Selling puts is generally a bullish proposition

- Selling puts generates income

- Typically puts are sold to generate a small amount of income based on the belief that the stock will trade above a certain price by a certain date

- Selling puts generally requires that your broker sets aside cash in your account in the event you are forced to buy stock if the stock price goes down. Example: if you sell a $16 put, your broker will set aside $1600 in case you are forced to buy 100 shares of stock at $16

Selling put options is generally considered a bullish bet. Traders selling puts believe the price of the stock will stay above the contract strike price that they sold the puts for. Let’s take a look at what could theoretically happen if you sold some put options contracts.

Ok, let’s go back to our favorite stock, XYZ. Stock XYZ is trading at $17/share. You think the price of the stock is a little too low, and that it is likely to go a bit higher. But your convictions aren’t quite strong enough to make you want to buy the stock at that price. You think there is still the possibility of a pullback before it moves up higher. But you can never be too sure because it’s a stock. So you decide to sell a put option contract. You go and look at put option contracts for next month at the $16 stock strike price. You see from the chart a few paragraphs above that they are going for 75 cents, so you decide to sell one put contract. Since you are selling something, you are making money. By selling this put contract you earn yourself $75 (75 cents for the contract times 100 shares in a contract). And that money is yours, no matter what happens to the price of the stock. Now let’s fast forward one month where the price of stock XZY is now at $19/share. We are on the day that the option contract executes/expires. Can you guess what is going to happen?

Since you sold a stock put option contract for the $16 stock price and the stock is now at $19/share, nothing more happens. Your contract won’t execute and you walk away with the $75 you earned when you sold the contract. But what would have happened to that contract if the stock was trading at $13/share instead of $19/share? Bad news. The person you sold the put option to would buy the stock for $13/share and turn around and sell it to you at $16/share since you sold your put option at the $16/share strike price. So you will lose $300 on the trade, minus the $75 you got for selling the put. On the bright side though, you did actually save money here. Instead of buying the stock at $17/share when you thought it was undervalued and losing $4/share when the price of the stock dropped down to $13/share, you only lose $3/share minus the $75 account credit thanks to acquiring the shares through a sold put. One important note to understand is that if the stock you sold puts in announces bankruptcy, someone will be buying shares for pennies to sell to you at a much higher price. So there is some risk of losing very big by selling puts. But there are ways to hedge against this if that is your worry. And that is a more advanced topic best saved for another post.

An important thing to know about selling puts is you generally can’t do it unless you have cash set aside in your account by your broker to be able to purchase the stock in full should the price of the stock move the wrong way on you. Since you have cash on hand to be able to buy the stock, this is called a cash-secured put.

Are Selling Put Options Right For You?

Put options can be a good way to make passive income and earn a little money every month or every week. But they aren’t for everyone. Because sold put options generally have to be backed by cash in your account, you can’t use that cash for other things. It gets withheld by your broker for as long as you have the sold put option contract in your account. So for example, if you sold a $16 put contract for 75 cents, your broker will set aside $1600 in your account in case you end up having to buy 100 shares of the stock at $16/share when the contract expires. That means you can’t use the cash to invest elsewhere until after the contract expires. So it may not be right for you. But if you are interested in a stock that you think might pullback, selling puts can be a good way to get invested in that stock. You can still make money on the stock in the event that it never pulls back, and you can also obtain the stock at a price lower than today’s price in the event it does pull back.

Are Buying Put Options Right For You?

From the earlier example I pointed out to you if you buy a put option contract and the stock never goes below the price you had in mind when you bought the contract, you lose all the money you spent on buying the contract. On the other hand, if the stock price falls well below the contract’s strike price, you can make a lot of money with very little money needed upfront. This is one of the allures of buying put option contracts.

One other reason that someone may buy a put option contract is to hedge their position in a stock they already own. Since you make money on the put contract you bought when the price of a stock goes down, you can use that to your advantage to minimize losses in a stock that you own. In the example above, we may own 100 shares of stock XYZ at a price of $17/share and decide to buy a put contract at a contract execution strike price of $15 for 50 cents. That would cap our maximum losses on stock XYZ at $2/share because if the stock price went down, we would lose money on our stock but at a price below $15 our losses are offset by the gains we get from the put contract. So that is another potential use case for buying puts.

So what do you think? Did this post give you a very basic understanding of how stock options work or did it leave you even more confused? Drop a comment down below and let me know.

Key Takeaways

- One standard stock option contract no matter if it is a put or a call is a contract good for 100 shares of stock

- Stock option contracts have dates that the contracts expire on

- Stock option contracts can do 1 of 3 things, expire, get executed, or voluntarily be terminated early

- Executed stock option contracts result in the transfer of shares of stock from one party to another

- If you buy a stock option contract you have the potential to lose your entire investment

- If you sell a stock option contract you will generate income but could limit your maximum gains

Questions You Should Be Able To Answer

You should not attempt to trade stock options if you do not understand the key takeaways above and you cannot answer the following questions:

- Why would someone want to buy calls?

- Why would someone want to sell calls?

- Why would someone want to buy puts?

- Why would someone want to sell puts?

Being able to answer those questions is a great start to understanding basic options strategies. Keep in mind though that options strategies do get much more complicated and involved than that.

Excellent, and a very good read for investors to learn about option trading.